Maritime transport crisis (shipping crisis). Possible causes and consequences

First, it is essential to understand that maritime transport has been, throughout history, a decisive factor in the dynamics of international trade. The construction of tankers, containerised ships for the transport of manufactured goods and ships for the transport of dry grains contributed greatly to the fact that, in trade relations, the geographical location of production was not the essential element in the determination of costs.

Today we can affirm without a doubt that it is a vital and strategic means of transport in the import and export of goods in a global scenario (between 80 and 90 % of world trade) in which there is a complex adaptation between Western industrial development and Asian manufacturing muscle. This is a productive scenario, considered today as a type of world economy in which emerging countries converge and exhibit surprising scientific and technological advances, which, in the short term, could significantly surpass the old Western economies. This increasingly accentuated dynamic translates into a scenario in which maritime transport is crucial to dynamise a type of economy that has geographically diversified the stages of production, seeking cheap labour in different areas of the planet and transporting products and parts easily and safely.

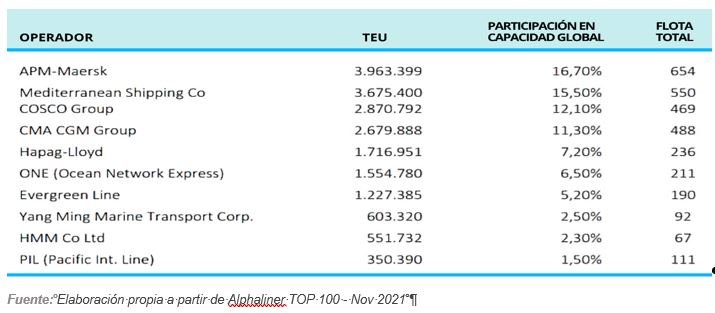

It is important to add that, according to maritime data analyst and consultancy Alphaliner, container shipping has been concentrated in five companies that control just over 60% of the world's shipping. Five other companies, smaller in terms of the potential they exhibit in fixed capital, account, in sum, for 80% of the total mobilised.

In order to address the crisis suffered by the shipping sector, it is essential to understand that before the outbreak of the pandemic, about a decade ago, the vulnerability of the sector to the fluctuations experienced by the economic reality of the global market had already been observed. The financial crisis of 2008 represented a surprising scenario for a shipping sector that had been growing at 10% per year. The oversupply of ships was beginning to contrast with the decrease in demand, which brought as an immediate consequence the collapse of service prices and, consequently, the exclusive capacity to meet the financial costs of operation. This reality continued for years, revealing, according to research by leading consultancy firms (Transport Intelligence, McKinsey, among others) that, between 2012 and 2016, the container shipping service lost approximately 84 million dollars.

More recently, before the pandemic, the sector has been experiencing a slight equilibrium, but with very low prices; however, the formation of strategic alliances between the larger companies was sustained, reflecting a policy of trying not to make the same mistakes in capacity investments or overproduction.

Another factor that surprisingly added to the diminishing expectations of the new shipping cartel that was being formed was the inevitable effect of gas emissions, which contributed enormously to the phenomenon of global warming and the consequent regulations established at various summits (Paris Agreement, Kyoto Protocol, Iberdrola, etc.), whose objective was focused on generating a sustainable development model of climate action to limit the harmful impacts of global maritime transport.

Aspects related to the existence of a regulatory framework to develop a slower type of navigation, the establishment of new routes according to the climate, the elimination of old ships that cannot adapt to change, the implementation of efficiency devices for propulsion and the use of counter-rotating propellers to save fuel and reduce greenhouse gas emissions, have been some of the demands and modifications necessary in the current context. However, it is estimated that gas emissions will increase by 50-250% by 2050.

With the arrival of the Covid 19 pandemic, the logistics chain was affected. Sanitary regulations significantly affected the production of important factories in China, and at the same time, the closure of ports generated a scenario in which fleets of loaded ships began to be observed, lining up in front of ports without functioning, and situations in which important interruptions of loading, unloading and delivery activities began to occur. This was a juncture at which companies determined that a severe collapse of commercial activities was beginning, which led to the establishment of contingency plans that led to the reduction of 11% of the world shipping fleet. Contrasting reality, a new concomitant phenomenon could be observed: the effects of the so-called "economic stimuli", made viable as a State policy to alleviate the effects of the demobilisation of labour and, therefore, the decrease in demand. These policies led to a strengthening of demand for manufactured goods, as evidenced by the 27% increase in cargo volumes moving between Asia and North America before the pandemic.

It is important to understand that, with an 11% decline in the world shipping fleet and an unexpected upturn in trade activity, freight rates increased significantly; a correlate of the declining capacity of fleets to move the unexpectedly growing trade activity.

Other factors adding to the current shipping crisis are: the increasing backlog of vessels in loading and unloading activities at port level due to the absence of qualified personnel, the floods in China, Europe and the United States that affected land and river transport, the severity around the application of restriction rules related to greenhouse gas emissions, the inconsistencies that arise when planned ports of destination are closed and unloading is resorted to at unplanned destinations, creating a messy situation where containers are often in short supply, and the increase in freight rates (from USD 3.3,000 to more than USD 12,000) as a result of unsatisfied demand, which leads to shortages of products and affects consumers' wallets.

Finally, it is vitally important to continue designing strategies at the company level that can help optimise business plans. The implementation of logistics programming processes to anticipate difficulties and guarantee efficient access to products and inputs should include: anticipating import processes, especially if the cargo comes from the Asian continent, the search for alternative markets (Europe and South America) to achieve shorter transit times and lower costs, a thorough evaluation of inventories to avoid stock-outs, and due advice with expert suppliers in the area of import and export of consumer goods, who are capable of providing solutions, regardless of geographical distances.